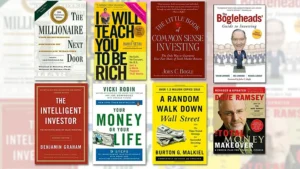

Investment books? Investment books are laced with wisdom written by proven authors who have succeeded in the investment game. As an aspiring investor, you must read to gain grounds in investing. So,in this post,I curated 10 of those books though there are still more, but let’s start with these. If you’re an aspiring investor, you might feel overwhelmed by the sheer volume of information available. But, reading the right books can set you on the path to financial success. Even if you want to understand stocks, real estate, or personal finance, there’s a book for that.

Investment books? Investment books are laced with wisdom written by proven authors who have succeeded in the investment game. As an aspiring investor, you must read to gain grounds in investing. So,in this post,I curated 10 of those books though there are still more, but let’s start with these. If you’re an aspiring investor, you might feel overwhelmed by the sheer volume of information available. But, reading the right books can set you on the path to financial success. Even if you want to understand stocks, real estate, or personal finance, there’s a book for that.

Let’s take a look at ten must-read investment books that will equip you with knowledge, strategies, and a sprinkle of inspiration. Grab a cozy blanket and a cup of coffee; we’re diving in!

1. The Intelligent Investor by Benjamin Graham

Let’s start with the granddaddy of investment books. Written by Benjamin Graham, often called the “father of value investing,” this book is a must-read for anyone serious about investing.

Key Takeaways:

- Value Investing Principles: Learn how to analyze stocks and bonds to find undervalued securities.

- Margin of Safety: Understand the importance of investing with a cushion to minimize risk.

In his book, Benjamin Graham said, “The stock market is designed to transfer money from the Active to the Patient.

This book isn’t just a textbook; it’s practically a roadmap to financial success. Remember, patience is key!

Fun Fact:

– A survey by GoodReads revealed that The Intelligent Investor is among the top 50 most influential books of all time.

2. Rich Dad Poor Dad by Robert Kiyosaki

If you want a book that’s less about stocks and more about mindset, look no further than Rich Dad Poor Dad. Kiyosaki contrasts the financial philosophies of his “rich dad” and “poor dad.”

Key Takeaways:

- Assets vs. Liabilities: Understand the difference and why acquiring assets is crucial.

- Financial Education: Learn that conventional schooling doesn’t always teach financial literacy.

Robert Kiyosaki said, “It’s not how much money you make, but how much money you keep.”

This book is like having a money-savvy uncle giving you the inside scoop on how to build wealth.

Statistics Alert:

– According to a study by the National Endowment for Financial Education, 70% of Americans feel unprepared for their financial futures. Kiyosaki’s book aims to change that!

3. The Little Book of Common Sense Investing by John C. Bogle

John C. Bogle, the founder of Vanguard Group, provides timeless wisdom in this compact book about investing in index funds.

Key Takeaways:

- Index Funds: Learn why low-cost index funds are an effective way to build wealth.

- The Market’s Average: Understand the importance of staying in the market for the long term.

John C. Bogle said, “The greatest enemy of a good plan is the dream of a perfect plan.”

Bogle’s straightforward approach makes this book a favorite among both new and seasoned investors.

Statistics Says:

– A report by Morningstar showed that over 80% of active fund managers fail to beat their benchmark index over a 15-year period.

4. A Random Walk Down Wall Street by Burton Malkiel

This book offers a humorous yet insightful take on investing, arguing that the market is unpredictable.

Key Takeaways:

- Efficient Market Hypothesis: Understand why stocks often reflect all available information.

- Investment Strategies: Explore various investment strategies and their effectiveness.

“The stock market is filled with individuals who know the price of everything, but the value of nothing.” – Burton Malkiel

Malkiel’s witty writing style makes complex concepts digestible. This book is perfect for anyone looking to grasp the basics of investing.

Fun Fact:

– The book is so popular that it has been updated multiple times since its first publication in 1973, reflecting the changing market landscape.

5. The Millionaire Next Door by Thomas J. Stanley and William D. Danko

Ever wonder where the real millionaires live? Spoiler alert: they’re not always in mansions. This book reveals the habits of America’s wealthiest individuals.

Key Takeaways:

- Frugality: Discover how millionaires tend to live below their means.

- Wealth Accumulation: Understand the importance of saving and investing.

“Wealth is not just about money; it’s about the lifestyle choices you make.” – Thomas J. Stanley

This book emphasizes that financial success often comes from discipline rather than high income.

Quick Stats:

– According to the authors, 80% of millionaires are self-made, not born into wealth.

6. The Richest Man in Babylon by George S. Clason

This classic uses parables set in ancient Babylon to teach timeless financial lessons. Don’t let the ancient setting fool you; these lessons are still relevant today.

Key Takeaways:

- Pay Yourself First: A principle that emphasizes saving a portion of your income.

- Invest Wisely: Seek advice from those who are knowledgeable in their field.

“A part of all you earn is yours to keep.” – George S. Clason

This book is a quick read, and its lessons are easy to remember. Perfect for those who want to get back to basics!

Fun Fact:

– The book has sold millions of copies since its first publication in 1926, proving that good advice never goes out of style.

7. You Are a Badass Making Money by Jen Sincero

If you’re looking for motivation, this is the book for you. Sincero combines self-help with practical advice on building wealth.

Key Takeaways:

- Mindset Matters: Understand the psychological barriers that may hold you back from wealth.

- Taking Action: Learn how to transform your financial dreams into reality.

“You are the only one who gets to decide how you feel about money.” – Jen Sincero

Sincero’s humorous style makes this book feel more like a conversation with a friend than a lecture.

Statistics to Note:

– According to a study by the American Psychological Association, financial stress is among the top stressors in American adults. Sincero’s book aims to alleviate that!

8. The Total Money Makeover by Dave Ramsey

If you’re looking to get out of debt and build wealth, Dave Ramsey’s book is a fantastic resource.

Key Takeaways:

- Baby Steps: Follow Ramsey’s proven plan for financial success.

- Debt Snowball: Learn how to pay off debt systematically.

“You must gain control over your money or the lack of it will forever control you.” – Dave Ramsey

Ramsey’s straightforward approach makes finance accessible for everyone, regardless of their starting point.

Quick Stats:

– According to Ramsey Solutions, 76% of people who follow his plan report a significant reduction in financial stress.

9. Principles: Life and Work by Ray Dalio

Ray Dalio, founder of Bridgewater Associates, shares principles that have guided him in investing and life.

Key Takeaways:

- Radical Transparency: Understand the importance of transparency in personal and professional dealings.

- Learning from Failure: Embrace mistakes as opportunities for growth.

“Mistakes are a part of the process; you learn from them.” – Ray Dalio

This book offers a unique blend of life lessons and investment advice, making it a must-read for aspiring investors.

Fun Fact:

– Dalio’s hedge fund is one of the largest in the world, and his insights are backed by years of experience.

10. The Psychology of Money by Morgan Housel

Finally, let’s wrap up with a book that dives deep into the emotional side of finance. Housel explores how our behaviors and mindset influence our financial decisions.

Key Takeaways:

- Behavioral Finance: Understand how emotions play a role in investing.

- Long-Term Perspective: Learn to think in decades, not days.

“Wealth is what you don’t see.” – Morgan Housel

This book is a refreshing take on personal finance and a great reminder that money is not just a numbers game.

Quick Stats:

– A survey by the Financial Planning Association found that 61% of Americans report feeling anxious about their financial situation. Housel’s book addresses these feelings head-on.

FAQs

Q1. How do I choose the right investment book for me?

A: Consider your current knowledge level and what you want to learn. Are you looking for basic principles, motivation, or advanced strategies?

Q2. How can I apply what I learn from these books?

A: Start small! Implement one strategy at a time and gradually build on your knowledge.

Q3. Are these books suitable for beginners?

A: Absolutely! Most of these books cater to beginners and provide foundational knowledge.

Q4. How often should I read investment books?

A: Make it a habit! Aim for at least one book a month to keep your financial education fresh.

Q5. Can I find these books in audio format?

A: Yes! Many popular investment books are available in audiobook format for convenient listening.

There you have it—the top ten must-read investment books for aspiring investors. Whether you’re looking to build wealth, get out of debt, or change your mindset, these books are your ticket to financial literacy.

Investing is not just about numbers; it’s a journey of learning, growth, and overcoming challenges. So, grab one (or all!) of these books, settle into your favorite reading nook, and prepare to transform your financial future.

Remember, as Benjamin Franklin said, “An investment in knowledge pays the best interest.” Happy reading!

cialis definition Tadal Access super cialis

how much does cialis cost at walgreens: generic cialis from india – order generic cialis

cialis professional 20 lowest price generic cialis online pharmacy or cialis without prescription

https://www.google.sm/url?q=https://tadalaccess.com liquid tadalafil research chemical

vardenafil vs tadalafil cialis 5mg review and canada pharmacy cialis tadalafil (megalis-macleods) reviews

cialis super active plus cialis generic over the counter or tadalafil tablets erectafil 20

https://toolbarqueries.google.com.sg/url?q=https://tadalaccess.com stendra vs cialis

cialis recreational use tadalafil review and cialis indien bezahlung mit paypal taking cialis

https://tadalaccess.com/# cialis mechanism of action

buy cialis online in austalia: cialis next day delivery – sildenafil vs cialis

cialis for sale toronto online cialis no prescription mail order cialis

cialis with dapoxetine cialis softabs online or tadalafil 5 mg tablet

https://hokejbenatky.cz/media_show.asp?type=1&id=205&url_back=https://tadalaccess.com tadalafil dapoxetine tablets india

where to buy cialis soft tabs cialis online without prescription and generic cialis 20 mg from india tadalafil tablets 20 mg reviews

https://tadalaccess.com/# tadalafil generic 20 mg ebay

can tadalafil cure erectile dysfunction: cialis generic – cipla tadalafil review

buying cialis online usa cialis 50mg п»їwhat can i take to enhance cialis

cialis side effect cialis lower blood pressure or when does tadalafil go generic

https://www.imp.mx/salto.php?va=http://tadalaccess.com cialis manufacturer coupon

cialis and dapoxetime tabs in usa is cialis covered by insurance and cheap cialis generic online what is the difference between cialis and tadalafil?

purchase cialis online cheap: cialis free samples – tadalafil (exilar-sava healthcare) version of cialis] (rx) lowest price

https://tadalaccess.com/# cialis purchase

what is cialis taken for Tadal Access when will generic tadalafil be available

buying cialis internet buy cialis online usa or brand cialis australia

http://www.google.com.ai/url?q=http://tadalaccess.com cialis not working

when to take cialis for best results generic cialis and how much is cialis without insurance how to buy tadalafil

cialis from canada order cialis online no prescription reviews buy cialis generic online

https://tadalaccess.com/# how much does cialis cost at walmart

buying cialis generic cialis none prescription or tadalafil brand name

https://www.google.gm/url?q=https://tadalaccess.com tadalafil prescribing information

cialis 20 mg best price buy tadalafil online canada and cialis time free cialis samples

cialis same as tadalafil cialis las vegas or mantra 10 tadalafil tablets

http://thenewsflashcorporation.net/eletra/site_signup_top.cfm?return=http://tadalaccess.com buying cialis generic

cheap cialis generic online where to buy tadalafil in singapore and generic cialis available in canada cialis before and after

cialis payment with paypal: buy cialis overnight shipping – what does cialis look like

buy tadalafil cheap online stendra vs cialis tadalafil citrate liquid

https://tadalaccess.com/# buy cialis online reddit

online tadalafil: Tadal Access – cialis substitute

cialis insurance coverage blue cross cialis no prescription overnight delivery over the counter cialis

cialis prescription cost: no prescription cialis – when to take cialis for best results

tadalafil review forum where to buy cialis online or cialis review

http://thewoodsmen.com.au/analytics/outbound?url=https://tadalaccess.com original cialis online

wallmart cialis cialis male enhancement and buy cialis overnight shipping cialis 80 mg dosage

cialis w/o perscription cialis onset or canadian pharmacy cialis 40 mg

http://alt1.toolbarqueries.google.ee/url?q=https://tadalaccess.com tadalafil cheapest price

cialis tadalafil snorting cialis and cialis no perscrtion cialis for sale toronto

cialis online usa cialis price or cialis for pulmonary hypertension

https://images.google.com.nf/url?sa=t&url=https://tadalaccess.com::: too much cialis

cialis com coupons cialis side effect and cialis genetic cost of cialis for daily use

https://tadalaccess.com/# cialis manufacturer

cialis dose TadalAccess typical cialis prescription strength

cialis tadalafil 20 mg: TadalAccess – super cialis

buy antibiotics: Biot Pharm – antibiotic without presription

Pharm Au24: Pharm Au24 – Medications online Australia

https://biotpharm.com/# best online doctor for antibiotics

where to buy erectile dysfunction pills Ero Pharm Fast discount ed meds

Over the counter antibiotics pills: buy antibiotics online uk – Over the counter antibiotics for infection

Ero Pharm Fast: Ero Pharm Fast – low cost ed meds

Online medication store Australia: PharmAu24 – Pharm Au 24

Over the counter antibiotics pills buy antibiotics from canada antibiotic without presription

https://pharmau24.shop/# PharmAu24

Ero Pharm Fast: Ero Pharm Fast – Ero Pharm Fast

where to buy ed pills: Ero Pharm Fast – erectile dysfunction meds online

buy antibiotics over the counter: buy antibiotics online – over the counter antibiotics

Ero Pharm Fast where to buy erectile dysfunction pills generic ed meds online

buy antibiotics from canada: buy antibiotics online – get antibiotics quickly

Online medication store Australia: Licensed online pharmacy AU – Online medication store Australia

https://eropharmfast.shop/# Ero Pharm Fast

get antibiotics quickly antibiotic without presription or buy antibiotics

https://maps.google.bj/url?sa=t&url=https://biotpharm.com best online doctor for antibiotics

buy antibiotics from canada best online doctor for antibiotics and Over the counter antibiotics for infection Over the counter antibiotics for infection

ed pills low cost ed medication or buy ed pills

https://images.google.lt/url?q=http://eropharmfast.com low cost ed meds online

ed medications online online ed medicine and cheapest ed treatment erectile dysfunction meds online

buy antibiotics over the counter: Biot Pharm – get antibiotics quickly

Ero Pharm Fast: how to get ed pills – buying erectile dysfunction pills online

pharmacy online australia Online medication store Australia or online pharmacy australia

https://clients1.google.no/url?sa=t&url=https://pharmau24.shop Pharm Au24

Pharm Au24 Licensed online pharmacy AU and Buy medicine online Australia PharmAu24

online ed pharmacy: ed treatments online – ed prescription online

Online drugstore Australia Discount pharmacy Australia Online drugstore Australia

Discount pharmacy Australia: Pharm Au 24 – Pharm Au 24

https://biotpharm.com/# buy antibiotics for uti

Ero Pharm Fast: online ed medications – discount ed meds

best ed meds online online erectile dysfunction prescription or ed medicine online

https://www.google.com.np/url?q=https://eropharmfast.com online erectile dysfunction pills

online ed prescription get ed meds online and ed meds by mail cheap erectile dysfunction pills

buy antibiotics from canada: buy antibiotics online – buy antibiotics from india

Online medication store Australia Online medication store Australia or online pharmacy australia

http://www.ssnote.net/link?q=http://pharmau24.shop Licensed online pharmacy AU

PharmAu24 online pharmacy australia and Online drugstore Australia PharmAu24

get antibiotics without seeing a doctor best online doctor for antibiotics or get antibiotics quickly

https://www.adminer.org/redirect/?url=http://biotpharm.com antibiotic without presription

buy antibiotics for uti buy antibiotics and buy antibiotics online get antibiotics quickly

get antibiotics quickly antibiotic without presription over the counter antibiotics

erectile dysfunction medicine online: where can i buy ed pills – Ero Pharm Fast

Ero Pharm Fast: Ero Pharm Fast – Ero Pharm Fast

low cost ed meds online ed meds online or cheap ed pills

http://go.sepid-dl.ir/index.php?url=https://eropharmfast.com buying erectile dysfunction pills online

best ed meds online erectile dysfunction drugs online and cheapest ed treatment ed medicine online

buy antibiotics for uti get antibiotics quickly or buy antibiotics over the counter

https://toolbarqueries.google.com.co/url?q=https://biotpharm.com get antibiotics without seeing a doctor

[url=http://www.torremarmores.com/en/gallery2/main.php?g2_view=core.UserAdmin&g2_subView=core.UserLogin&g2_return=https://biotpharm.com]buy antibiotics from india[/url] Over the counter antibiotics pills and [url=http://www.superiptv.com.cn/home.php?mod=space&uid=122457]antibiotic without presription[/url] Over the counter antibiotics for infection

low cost ed pills order ed pills or ed med online

https://tour.catalinacruz.com/pornstar-gallery/puma-swede-face-sitting-on-cassie-young-lesbian-fun/?link=http://eropharmfast.com/ erectile dysfunction drugs online

how to get ed meds online cheapest ed meds and ed online treatment best online ed medication

4tlyup

javdru

rpizqt

3e32s8

4xbqbk

деньги на карту без отказа срочно деньги на карту без отказа срочно .

банки взять кредит без отказа на карту банки взять кредит без отказа на карту .

iezzet

vik6nz