Influential investors are people who have thrived and is still thriving in the world of investing, learning from the best can be the difference between a thriving portfolio and a life spent scrolling through social media in a desperate attempt to forget your financial woes. While we can’t all be the next Warren Buffett, we can certainly learn from the financial gurus who paved the way. In this blog, we’ll dig into the lives and wisdom of the 10 most influential investors of our time. By the end, you’ll have plenty of lessons to grasp as you navigate the turbulent waters of finance.

Why Do Investors Matter?

Investors shape markets. They’ve changed economies, launched successful companies, and, let’s be honest, appear to derive great joy from foiling optimistic young investors on their way up the ladder.

– They push boundaries.

– They inspire future generations.

– They know their way around a balance sheet like the rest of us know our way around the snack aisle.

1. Warren Buffett: The Oracle of Omaha

Ah, Warren Buffett. If there’s one name synonymous with successful investing, it’s his. Known as the “Oracle of Omaha,” Buffett is a value investor who believes in buying undervalued stocks and holding onto them for the long haul.

What You Should Learn from the Influential Investor:

- Patience is Key: Buffett famously says, “The stock market is designed to transfer money from the Active to the Patient.”

- Invest in What You Know: Always do your homework. Find industries or sectors you’re comfortable with.

- Diversification is Overrated: Buffett advises keeping your portfolio simple. “Put all your eggs in one basket, and then watch that basket.”

2. George Soros: The Man Who Broke the Bank of England

Soros made a name for himself during the 1992 Black Wednesday crisis when he shorted the British pound and made a cool billion in a single day. Not too shabby.

What You Should Learn from the Influential Investor:

- Embrace Risk: “I am only rich because I know when I’m wrong,” Soros states, highlighting the importance of risk management.

- Market Psychology: Understanding the emotional drivers of the market can lead to better investment decisions.

- Adaptability: Stay agile. The market changes, and so should your strategy.

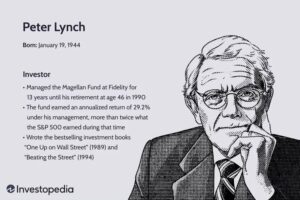

3. Peter Lynch: The Magician of Magellan

As a fund manager for the Fidelity Magellan fund, Peter Lynch turned a $20 million investment into over $14 billion in 13 years. He shared his mantra of “invest in what you know” long before it was a trend.

What You Should Learn from the Influential Investor:

- Do Your Homework: Lynch said, “Know what you own, and know why you own it.” This isn’t a field trip; it’s your future.

- Look for Growth: Keep an eye out for companies with solid fundamentals and growth potential.

- Stay Informed: Being informed about macroeconomic trends can help you make better investment choices.

4. Ray Dalio: The Hedge Fund Guru

Ray Dalio founded Bridgewater Associates, one of the world’s largest hedge funds. His principles of radical transparency and meritocracy are something investors admire.

What You Should Learn from the Influential Investor:

- Embrace Reality: Dalio says, “Pain + Reflection = Progress.” Acknowledge mistakes to learn and grow.

- Understand Divergence: Often, there’s no right answer. Different strategies will work for different situations.

- Diversity Strategies: A diversified portfolio can cushion against financial storms.

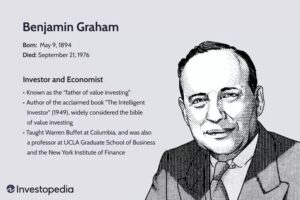

5. Benjamin Graham: The Father of Value Investing

Before Buffett became famous, there was Benjamin Graham. Often dubbed the “Father of Value Investing,” his philosophy laid the groundwork for many investors today.

What You Should Learn from the Influential Investor:

- Look at Intrinsic Value: “Price is what you pay; value is what you get,” said Graham. Always evaluate the underlying worth of an investment.

- Margin of Safety: Invest with caution. Ensure buffer by analyzing risks thoroughly before jumping in.

- Don’t Rely on Market Trends: Focus on fundamental analysis rather than trends, which can be deceiving.

6. John Paulson: The Guy Who Bet Against the Housing Market

Remember that guy who saw the housing crisis coming like a prophecy from the future? That’s John Paulson for you. He made billions during the mortgage meltdown of 2008.

What You Should Learn from the Influential Investor:

- Follow Your Instincts: Sometimes, trusting your gut can lead to lucrative outcomes.

- Research is Crucial: Paulson conducted thorough research before his big bets. Never skip the details.

- Be Prepared for Uncertainty: The market is unpredictable; plan for various scenarios to protect yourself.

7. Carl Icahn: The Corporate Raider

Carl Icahn is known for his activist investing style, often buying significant stakes in companies to push for operational improvements or management changes.

What You Should Learn from the Influential Investor:

- Be Bold: Icahn emphasizes that reaching the top isn’t for the faint of heart. “The most important thing is to be honest with yourself.”

- Take Action: He believes in taking calculated risks and making your voice heard in corporate governance.

- Focus on Value Creation: Look for ways to create value in your investments.

8. Cathie Wood: The Disruptor of Traditional Finance

Leading the charge for innovation, Cathie Wood is known for her investment style focusing on disruptive technologies. Her firm, ARK Invest, has gained massive attention.

What You Should Learn from the Influential Investor:

- Spot Trends Early: Wood’s approach often hinges on identifying future trends sooner than others—high risk, high reward.

- Include Tech Stocks: Don’t underestimate the power of disruptive innovation. It’s changing industries.

- Stay Resilient: “I think we’re in a new order,” she often says, reminding us that adaptability leads to success.

9. David Einhorn: The Contrarian Investor

With a knack for short-selling and value investing, David Einhorn founded Greenlight Capital and has often seen success against conventional wisdom.

What You Should Learn from the Influential Investor:

- Question Conventional Wisdom: Einhorn once said, “The most important thing is to be able to look at the numbers differently.”

- Value Over Hype: Shun popular belief; often, the recognized “hot” stock is overrated.

- Patience: Big returns may take time. Stay the course.

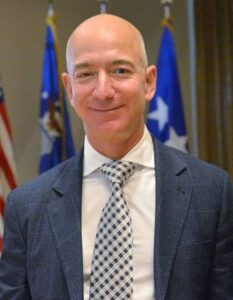

10. Jeff Bezos: The Visionary

While primarily known as the founder of Amazon, Jeff Bezos has also made significant straits into investing through the Bezos Expeditions venture capital firm.

What You Should Learn from the Influential Investor:

- Think Long-Term: Bezos is famous for saying, “We’re willing to be misunderstood for long periods of time.” Long-term perspectives yield great results.

- Customer-Centric Approach: Invest in companies that prioritize customer satisfaction. Happy customers lead to successful businesses.

- Diversification is Important: Bezos advises to expand and invest in multiple areas for overall growth.

Conclusion: Lessons from the Influential Investors

Studying the lives of these influential investors shows us that investing isn’t merely about the numbers. It’s about strategy, patience, courage, and decision-making in the face of uncertainty. Embrace their lessons, and who knows? You may be the next big name in investing.

FAQs

Q1. How can I start my investment journey?

A: Start small! Educate yourself on different investment types, set clear goals, and consider speaking to a financial advisor.

Q2. What’s the best investment strategy?

A: There’s no one-size-fits-all; some prefer value investing, while others lean towards growth or tech stocks. Choose what works best for you.

Q3. How important is diversification?

A: Very! Diversifying your investments helps to spread risk and may lead to greater returns over time.

Q4. Are there benefits to investing in stocks early?

A: Absolutely! The earlier you start, the longer your money can grow through compounding interest.

Q5. Should I follow trends in investing?

A: Trends can be beneficial, but it’s vital to conduct your own research and avoid decisions solely based on hype.

It’s time to channel your inner investor and write your financial success story based on the valuable lessons from these titans of investing!

be23qv