Top 7 Wealth – Building Habits of Successful People

Wealth is not just about how much money you make. It’s about the habits you build over time that help you grow and protect your money. Studies from respected universities and financial experts show that successful people share certain behaviors that help them build lasting wealth. For example, research by the University of Chicago’s Booth School of Business found that people who consistently save and invest tend to accumulate significantly more wealth over their lifetime. But what exactly are these habits, and how can you apply them in your life? Are you ready to discover the proven strategies that can transform your financial future?

Why Habits Matter in Building Wealth

Before diving into the specific habits, it’s important to understand why habits are so powerful. Habits shape our daily actions, and our daily actions shape our results. According to a study published in the *European Journal of Social Psychology*, about 40% of our daily behaviors are driven by habits, not conscious decisions. This means that if you develop good financial habits, they will automatically guide your money decisions without requiring constant effort.

Successful people don’t rely on luck or sudden windfalls. Instead, they build wealth steadily by practicing smart habits every day. These habits help them avoid common money traps, reduce stress, and create opportunities for growth. So, what are these habits? Let’s explore the top seven.

—

1. Pay Yourself First: The Foundation of Financial Interest

One of the most important habits of wealthy people is paying themselves first. This means that as soon as you receive your income, you immediately set aside a portion for savings and investments before paying any bills or spending on anything else.

Why This Habit Works

Paying yourself first ensures that saving becomes a priority rather than an afterthought. According to a report by the Federal Reserve, Americans who save regularly are more likely to have emergency funds and invest for retirement. Automating savings through direct deposits or automatic transfers can make this process effortless.

The Power of Compound Interest

Albert Einstein reportedly called compound interest the “eighth wonder of the world.” When you save and invest early and consistently, your money earns interest, and that interest earns interest in return. Over time, this growth can be exponential. For example, if you invest $200 a month at an average annual return of 7%, in 30 years, you could accumulate over $200,000.

Expert Insight

Dave Ramsey, a well-known personal finance expert, advises,

“You must gain control over your money or the lack of it will forever control you.”

Paying yourself first is a way to take control and build a safety net for your future.

How to Start

– Decide on a fixed percentage or amount to save from each paycheck (10-20% is a good start).

– Set up automatic transfers to a savings or investment account.

– Treat this saving as a non-negotiable monthly expense.

—

2. Live Below Your Means: The Secret to Sustainable Wealth

Living below your means means spending less money than you earn. It sounds simple, but it requires discipline and conscious decision-making.

The Reality of Lifestyle Inflation

A common trap many people fall into is lifestyle inflation — increasing spending as income rises. According to a study by the University of California, Berkeley, lifestyle inflation is one of the biggest reasons people fail to build wealth despite earning more.

How the Wealthy Do It

Research by Thomas J. Stanley and William D. Danko in The Millionaire Next Door found that most millionaires live modestly. They don’t buy luxury cars or expensive homes beyond their means. Instead, they prioritize saving and investing.

Warren Buffett’s Advice

Warren Buffett, one of the richest people in the world, famously said,

“Do not save what is left after spending, but spend what is left after saving.”

This mindset flips the usual spending pattern and puts saving first.

Practical Tips

– Track your expenses to understand where your money goes.

– Create a budget that prioritizes needs over wants.

– Avoid debt for non-essential purchases.

– Resist peer pressure to keep up with others’ spending habits.

3. Continuous Financial Education: Stay Ahead with Knowledge

The financial world is always changing. Markets fluctuate, new investment products emerge, and tax laws evolve. Successful people stay informed by continuously learning about money.

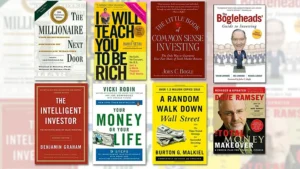

10 Must-Read Investment Books for Aspiring Investors

Why Education Matters

A study by the National Endowment for Financial Education found that individuals who seek financial education are more confident and make better money decisions. Knowledge reduces fear and uncertainty, which can prevent costly mistakes.

How to Gain Knowledge

- Read books by trusted authors like Benjamin Graham and Suze Orman.

- Listen to financial podcasts such as The Dave Ramsey Show or Planet Money

- Attend workshops or online courses from reputable institutions.

- Follow credible financial news sources like CNBC, Bloomberg, or Forbes.

Benjamin Franklin’s Wisdom

Benjamin Franklin said,

“An investment in knowledge pays the best interest.”

This quote highlights that learning about money is one of the best investments you can make.

How to Make It a Habit

– Dedicate 15-30 minutes daily or weekly to financial reading or listening.

– Set learning goals, such as understanding a new investment type each month.

– Join online forums or groups focused on personal finance.

—

4. Set Clear Financial Goals and Plan Strategically

Without clear goals, it’s easy to lose direction. Wealthy individuals set specific financial goals and create plans to achieve them.

Transform Your Finances with Strategic Planning: From Debt to Wealth

The Importance of SMART Goals

Goals should be Specific, Measurable, Achievable, Relevant, and Time-bound (SMART). For example, “Save $10,000 for an emergency fund in 12 months” is better than “Save more money.

Research on Goal-Setting

According to a study by Dr. Gail Matthews at Dominican University, people who write down their goals are 42% more likely to achieve them. Having a plan helps maintain focus and motivation.

How to Create a Financial Plan

– List your short-term (1 year), medium-term (3-5 years), and long-term (10+ years) goals.

– Break down each goal into monthly or weekly targets.

– Review your progress regularly and adjust as needed.

Benefits of Planning

– Helps prioritize spending and saving.

– Reduces financial stress by providing clarity.

– Increases chances of reaching milestones like buying a home or retiring early.

5. Diversify Income Streams: More Than One Way to Earn

Relying on a single paycheck can be risky. Wealthy people often have multiple income sources.

Why Diversify?

The 2008 financial crisis showed how job loss or economic downturns can devastate finances. Having several income streams provides a buffer and accelerates wealth building.

Common Additional Income Sources

– Rental properties

– Dividend-paying stocks

– Side businesses or freelancing

– Royalties or online content creation

– Peer-to-peer lending or crowdfunding investments

Robert Kiyosaki’s Take

Robert Kiyosaki, author of Rich Dad Poor Dad, says,

“The rich don’t work for money; they have money work for them.”

This means creating passive income streams that generate money with little ongoing effort.

How to Start Diversifying

– Identify your skills or interests that could generate extra income.

– Research investment options that fit your risk tolerance.

– Start small and reinvest earnings to grow your income sources.

—

6. Practice Mindful Spending: Control Your Money, Don’t Let It ControBuying

Mindful spending means making intentional choices about where your money goes. It’s about aligning spending with your values and goals.

The Problem with Impulse Buying

Impulse purchases often lead to buyer’s remorse and wasted money. A survey by CreditCards.com found that 54% of Americans admit to making impulse buys regularly.

How Mindful Spending Helps

By pausing before buying, you can decide if the purchase truly adds value. This habit reduces unnecessary expenses and frees up money for saving or investing.

Tips for Mindful Spending

– Wait 24 hours before making non-essential purchases.

– Ask yourself if the item supports your financial goals.

– Focus on quality over quantity to avoid frequent replacements.

– Use cash or debit cards to limit overspending.

—

7. Build a Strong Network and Seek Mentorship

Your financial habits and success can be influenced by the people around you. Successful individuals build networks and seek mentors to guide them.

Building Relationships That Sell: Wealth Management

The Power of Networking

Networking opens doors to new opportunities, partnerships, and knowledge. According to a LinkedIn survey, 85% of jobs are filled through networking, showing how valuable connections are.

Mentorship Benefits

Mentors provide advice, accountability, and encouragement. They help you avoid common pitfalls and accelerate your learning curve.

Jim Rohn’s Quote

Jim Rohn said,

“You are the average of the five people you spend the most time with.”

Surrounding yourself with financially savvy people can positively impact your habits and mindset.

How to Build Your Network

– Attend industry events or financial workshops.

– Join online communities focused on personal finance.

– Reach out to potential mentors via email or social media.

– Offer value in return, such as sharing useful information or helping others.

—

FAQs

How much of my income should I save to build wealth?

Financial experts recommend saving at least 20% of your income. This includes contributions to retirement accounts, emergency funds, and other investments. The key is consistency over time.

Is it better to pay off debt or invest first?

It depends on the interest rates. Generally, pay off high-interest debt (like credit cards) before investing. For low-interest debt, you can balance paying it down while investing.

Can I build wealth on a low income?

Yes. Building wealth is about habits, not just income. Living below your means, saving consistently, and investing wisely can help anyone grow their wealth over time.

What’s the best way to start investing?

Start with low-cost index funds or exchange-traded funds (ETFs). These provide diversification and have lower fees. Many platforms allow you to begin with small amounts.

How often should I review my financial goals?

Review your goals at least quarterly. Life changes, and your goals might need adjusting. Regular reviews help you stay on track and make necessary adjustments.

Building wealth is a journey made up of daily choices. The habits of successful people are not secrets; they are simple, consistent actions anyone can take. Paying yourself first, living below your means, continuing your financial education, setting clear goals, diversifying income, spending mindfully, and building a strong network are all proven strategies.

The data and expert advice are clear: wealth is built over time through good habits, not quick fixes. So, what habit will you start today to take control of your financial future? The power to change your money story is in your hands.

—

References and Further Reading

– Thomas J. Stanley and William D. Danko, *The Millionaire Next Door*

– Federal Reserve Report on Household Savings

– University of Chicago Booth School of Business Research on Wealth Accumulation

– National Endowment for Financial Education Studies

– Benjamin Franklin Quotes and Financial Wisdom

– Dave Ramsey’s Financial Principles

– Robert Kiyosaki, *Rich Dad Poor Dad*

– LinkedIn Networking Surveys

For more in-depth financial advice, visit trusted websites like [Forbes](https://www.forbes.com), [CNBC](https://www.cnbc.com), and [Investopedia](https://www.investopedia.com).

—

This comprehensive guide is designed to help you understand and adopt the wealth-building habits that successful people practice daily. With patience and persistence, you can create a secure and prosperous financial future.

nnftwq

9fbdma

xd7o2l

yvkehx