Retirement is a word that brings up images of sunny beaches, golf courses, and finally having that time to do absolutely nothing—or everything you’ve ever wanted. But let’s face it, transitioning into retirement isn’t just about giving your boss the finger (we’ve all thought about it) and starting a life of leisure. It’s a substantial change that can lead to either blissful freedom or utter confusion. So, how do you move from the daily grind to the sweet life of retirement smoothly and confidently? Buckle up because we’re diving into seven essential tips that will help guide you through this pivotal phase of your life.

What is the Retirement Transition?

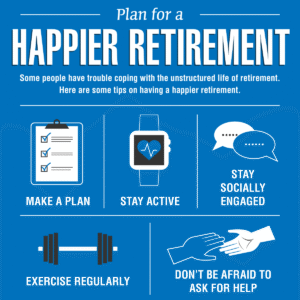

The retirement transition is the significant phase when you move from your working years into retirement. It’s more than just adjusting your sleep schedule to accommodate sleeping in. It requires proper planning to ensure your financial stability, social engagement, and personal well-being. The process can be complex, fraught with uncertainties, but that’s why we have tips!

As the financial guru Suze Orman aptly put it, “You can’t get to where you want to go if you don’t know where you’re starting from.” In the context of retirement, where you start is crucial for those sunny beach days.

—

Tip 1: Evaluate Your Financial Situation

Let’s start with the elephant in the room: money. You might have dreams of sipping cocktails on the beach, but can you afford that lifestyle? Here’s how to evaluate your financial standing:

- Check Your Savings: Look at your retirement accounts (401(k), IRA, etc.) and savings. Here’s a fun fact: According to the Economic Policy Institute, the average retirement savings for families in their 60s is around $200,000. Not bad, but are you average?

- Create a Budget:Retirement isn’t just an endless vacation; you’ll have expenses. What will your post-retirement expenses look like? Calculate your expected monthly costs to see if your savings can handle it.

- Consult a Financial Advisor: Don’t go at it alone. A financial planner can provide insights based on your unique situation and help ensure you’ll be sipping those cocktails, not water in a cafeteria.

Did you know that 64% of Americans have less than $10,000 saved for retirement? Yikes! The key takeaway? Don’t be part of this statistic!

—

Tip 2: Define Your Post-Retirement Goals

Now, what exactly do you want to do when you retire? The answer might not be “sit on the couch all day” (or maybe it is?). Defining your goals is crucial for achieving a fulfilling retirement. Here’s how:

- Think Beyond Travel: Yes, travel is great! But what about hobbies? Volunteering? Picking up that guitar you never learned? Brainstorm what activities excite you.

- Set Short-term and Long-term Goals: Creating specific goals keeps you motivated. Want to learn how to fly a plane? Have a roadmap—perhaps take a class this year.

- Get Real with Your Timeline: Like any good plot twist, your plans can change. Be open to adjusting goals based on your resources and interests.

“Retirement is not the end of the road. It is the beginning of the open highway.” —Anonymous. So, where will your highway take you?

—

Tip 3: Stay Socially Connected

There’s truth to the saying, “no man is an island.” When you retire, you may find yourself staring at four walls more often than you’re comfortable with. Here are ways to maintain social connections:

- Join a Group: Look for clubs or organizations in your community that align with your interests. Whether it’s a book club or a local gardening group, mingling is crucial.

- Stay in Touch with Work Colleagues: Just because you’re not working doesn’t mean you can’t keep up with friends from the office. Schedule regular meet-ups for coffee or lunch.

- Volunteer: It’s a fantastic way to meet new people while giving back! Plus, you get some warm fuzzies as an added bonus.

According to a study by the National Institute on Aging, social engagement can increase life expectancy by up to 50%. Who knew being a social butterfly could add years to your life?

—

Tip 4: Invest in Your Health

Retirement is about enjoying yourself, right? Well, what good is it if you’re not healthy? Here’s how to make your health a priority:

- Regular Check-Ups: Don’t skip those check-ups just because you have extra time now. Early detection is key—no one wants to be surprised by a diagnosis!

- Exercise Regularly: Find something you enjoy—walking, dancing, swimming. Exercise releases endorphins, keeping you happy and active.

- Eat Healthy: Now is the time to start that plant-based diet you’ve been hearing about, or at the very least, consume those veggies. Your body will thank you!

“Take care of your body. It’s the only place you have to live.” —Jim Rohn. So, how about we make that place as comfy as possible?

—

Tip 5: Find a New Routine

“Wait, I’m supposed to have a routine in retirement?” you may ask. Yes! Routines provide structure and a sense of purpose. Let’s get started:

- Set a Daily Schedule: Even if it’s a relaxed schedule, having a plan gives your day a shape. Want to walk every morning? Schedule it!

- Balance Work and Play: You might consider staying engaged part-time. It doesn’t have to be a full-time gig—just enough to keep your brain sharp while still allowing you time for leisure.

- Embrace Flexibility: While schedules are good, remember that spontaneity can also offer joy. Mix it up!

Researchers at the University of California suggest that having a routine can significantly improve mental health and well-being, especially during significant life changes.

—

Tip 6: Prepare for Emotional Changes

Brace yourselves—retirement can be an emotional rollercoaster. One day you’ll be excited, and the next, you might question your entire life. Here’s how to navigate this rocky terrain:

- Acknowledge Feelings: It’s normal to feel a range of emotions. Don’t shy away from them—talk to friends or a professional if you need to.

- Stay Engaged: Involvement in hobbies, social events, and family activities can keep those blues at bay.

- Mindfulness and Meditation: Techniques like meditation can aid in managing emotional upheaval. It’s a good way to recharge your mental battery.

“Retirement: when you stop living at work and begin working at living.” —Anonymous. Take this time to really live, even if it means pushing through the tough days.

—

Tip 7: Don’t Forget Estate Planning

Ah, the fun part— estate planning! It might not be the beach day you dreamed of, but it’s a crucial aspect of planning for your future. Here’s how to approach it:

- Create/Wills and Trusts:bEnsure your assets are distributed according to your wishes. Let’s not leave it to the chaos of intestacy laws!

- Review Beneficiaries: Names change, life situations change—make sure your beneficiary designations are current.

- Power of Attorney: Decide who will make decisions on your behalf if you can’t. Trust is critical here!

Nearly 70% of adults don’t have a will or estate plan. Don’t be part of this statistic!

—

FAQs

Q1. What is the average age of retirement?

A: The average retirement age in the U.S. is between 61 and 65 years, but this varies based on personal circumstances and preferences.

Q2. How much money do I need to retire comfortably?

A: Experts recommend having a retirement savings equivalent to at least 10-12 times your final salary. It’s never too late to start planning!

Q3. Can I work part-time during retirement?

A: Absolutely! Many retirees choose to work part-time for extra income and social engagement. Just make sure it aligns with your retirement goals.

Q4. How can I keep busy during retirement?

A: Pick up hobbies, volunteer, travel, spend time with family, or learn a new skill. The world’s your oyster!

Q5. Is it normal to feel lost after retiring?

A: Yes! Many people experience mixed emotions. It’s perfectly normal to take time figuring out your new routine and goals.

—

In conclusion, transitioning into retirement doesn’t have to feel like you’re being thrown into the deep end. By evaluating your finances, defining goals, maintaining social ties, focusing on health, creating a routine, preparing for emotional changes, and getting your estate in order, you can transition smoothly and confidently into this next exciting chapter. After all, “Retirement is not the end; it’s the beginning of everything you ever wanted.”

So, shake those worries off, grab a cocktail (preferably one of those cute umbrellas), and enjoy the ride! Cheers to your fabulous retirement!

ol1fh9

toedaj

5vnphv

rpn0a7

o781ih

mw0t9n